Let me guess what happened last Tuesday. You walked into the quarterly budget meeting with a sustainability proposal—reusable packaging systems, waste-to-revenue programs, zero waste certification. The CEO nodded. Marketing loved the PR angle. Then your CFO pulled up a spreadsheet, pointed to the upfront capital expenditure, and your circular economy dreams died in Conference Room B.

Here’s what nobody tells you about zero waste business models: The biggest barrier isn’t technology—it’s internal politics wrapped in financial anxiety. Your procurement director has a 15-year vendor relationship. Your operations manager gets bonuses for quarterly efficiency, not three-year sustainability curves. And your CFO? They’re looking at immediate budget pain while disposal costs bleed slowly across fiscal years, hidden in “facilities contracts” that never appear on performance dashboards.

The companies that break through aren’t the ones with bigger budgets—they’re the ones who learned to speak a different language. Not environmental charity. Not “doing good.” But risk mitigation, revenue optimization, and regulatory defense.

Industrial Waste Cost Accounting: True Lifecycle Economics

Your company is hemorrhaging money on waste disposal, but your accounting system hides it. Walk down to finance and ask them to show you total waste disposal costs across all facilities. Watch them scramble between three budget categories—facilities operations, logistics contracts, and “miscellaneous operational expenses.”

Traditional procurement creates perverse incentives. Single-use packaging shows up as a lower line item because you’re only seeing material cost, not end-of-life disposal. That disposal expense lives in a different department’s budget, paid to a waste hauler under a contract that auto-renews with 8-12% annual increases nobody questions.

The uncomfortable truth: Your “cheap” disposable packaging is expensive—you’ve just spread the cost across enough categories that no single person feels the pain.

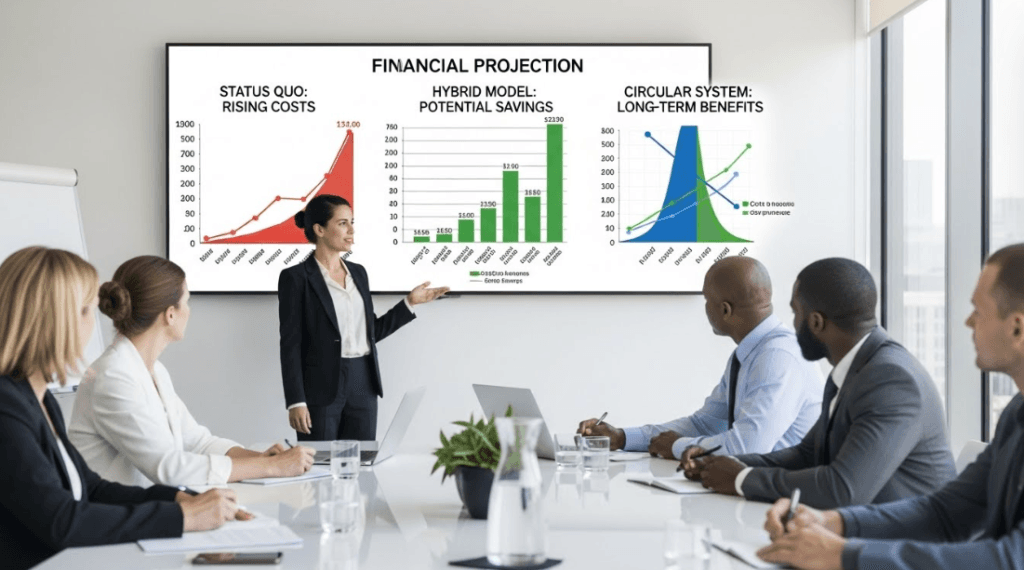

Circular supply chain implementation fixes this by forcing true cost accounting. When you shift to reusable systems, all costs live in one place—capital expenditure on containers, return logistics, cleaning systems. It looks scary in a spreadsheet because you’re seeing the full picture for the first time. But after month 18-24, you stop paying disposal costs entirely. That line item disappears. Forever.

The breakeven math is simple: Calculate your current annual waste disposal spend (include hauling fees, landfill tipping fees, environmental compliance charges). Add 8% annual increases for the next five years as landfill taxes rise. Compare that to the one-time capital cost of reusable systems plus maintenance. For most B2B circular economy operations, reusables become cheaper between month 18 and 36. After that? Pure savings, compounding annually.

Zero Waste Business Model Pitch Scripts for Corporate Buy-In

The social cringe is real. You’re sitting across from your procurement director—a person who’s optimized vendor relationships for 20 years—and you’re about to suggest they “disrupt” their supply chain for sustainability reasons. You can feel the eye-roll building.

Stop leading with environmental benefits. Your CFO doesn’t care about carbon footprints when hitting quarterly earnings targets. But you know what keeps them awake? Regulatory penalties they can’t predict and rising costs they can’t control.

Extended Producer Responsibility laws are rolling out now. These regulations make companies financially responsible for the entire lifecycle of their packaging—including disposal costs that end up in customer trash. If you’re selling products in the EU, California, or Canada, you’re already on the hook or will be within 24 months. Early implementations show fees of $0.08-0.15 per pound of non-recyclable packaging.

This is your leverage. You’re not proposing a sustainability initiative—you’re proposing regulatory insurance.

“Our current waste disposal contract renews in [X months]. I’ve calculated three scenarios: Status quo with projected landfill tax increases, hybrid transition with 30% reusables, and full circular system. At month 18, the hybrid model costs 14% less than continuing disposal contracts. More importantly, it eliminates our exposure to Extended Producer Responsibility laws coming in [relevant jurisdiction]. This isn’t about being ‘green’—it’s about not paying penalty taxes in 2026 when regulators make us responsible for end-of-life costs anyway. We either control this transition now at planned cost, or pay emergency premiums later.”

Notice what’s NOT in that script: Polar bears. Carbon footprints. “Doing the right thing.” You’re speaking the language of risk management and cost control.

Circular Supply Chain Roadmap: 30-Day Implementation Guide

Week 1—The Audit (No Permission Required):

Don’t ask for budget. Don’t schedule a task force. Just quietly audit your top five material suppliers. Send a simple email: “Do you offer takeback programs or reusable packaging options for [specific product]? We’re evaluating lifecycle costs for our procurement review.”

Here’s what you’ll discover: Most B2B suppliers already have dormant circular programs. They built them for European clients facing stricter regulations but never marketed them to US customers who weren’t asking. You’re not inventing a new system—you’re accessing an existing one.

Focus on internal logistics first, not customer-facing packaging. The lowest-hanging fruit is repetitive shipments between your own facilities—warehouse to warehouse, plant to distribution center. These routes are predictable, controlled, and don’t require customer behavior change. If you ship 200 pallets monthly from your Indiana plant to your Texas warehouse using disposable packaging, that’s your pilot program target.

Week 2—The Inevitable Pushback (And How to Neutralize It):

Your operations manager will torpedo your plan with: “Reusable containers cause cleaning delays and contamination issues.” This objection has killed more B2B circular economy initiatives than lack of budget. Here’s why it lands—it’s partially true.

The mistake companies make is assuming they need to clean reusable containers at the destination facility. You don’t. Build cleaning costs into your return logistics contract with your freight partner. Third-party logistics companies already run pallet pooling services where they collect, clean, and redistribute wooden pallets across multiple clients. You’re just adding your custom containers to their existing loop.

The physical reality of success: Your receiving dock needs a designated “outbound empty container” staging area—a marked zone of floor space (8×10 feet minimum) with clear signage. When your freight company arrives for their next scheduled pickup, they load empty containers onto the same truck returning to your supplier’s region. No special trips. No new routes. You’re utilizing existing backhaul capacity that was running empty anyway.

Month 1—Making It Permanent (The Spreadsheet That Changes Behavior):

Create a “Circular Materials Matrix.” Open a shared spreadsheet with four columns:

- Column A: Current disposable item (be specific: “24x18x12 corrugated boxes, single-wall, brown”)

- Column B: Reusable equivalent (include vendor name and part number)

- Column C: Breakeven timeline in months (calculate: reusable unit cost ÷ monthly disposable spend = payback period)

- Column D: Regulatory risk score (High = customer-facing packaging in regulated jurisdictions, Medium = B2B packaging, Low = internal logistics)

Update this quarterly. But here’s the behavior change that makes it stick: Train your purchasing staff to filter every new packaging contract through this matrix. Make it a required field in your procurement approval workflow. When someone submits a purchase order for disposable materials, the system automatically asks: “Have you checked the Circular Materials Matrix for reusable alternatives?”

You’re not asking people to be more sustainable. You’re changing the default checklist so circular procurement becomes the path of least resistance.

Waste-to-Revenue Streams: B2B Material Recovery Programs

Let’s talk about the psychological block keeping your company from making money on waste materials. Your finance department has categorized waste disposal as an operational expense under “facilities.” It lives in the same mental bucket as janitorial services and HVAC maintenance—things you pay for to keep the building running.

This accounting structure makes it impossible for your team to see waste as inventory with potential value. When your sustainability manager suggests selling food waste to a composting facility, finance responds with confusion: “We don’t sell garbage. That’s not our business model.”

But here’s the reframe that unlocks revenue: You’re not selling waste. You’re optimizing material yield from your production process. A brewery doesn’t “sell waste grain”—they maximize barley utilization by ensuring spent grain becomes cattle feed. A furniture manufacturer doesn’t “sell sawdust”—they recover value from wood fiber that didn’t make it into the final product.

Same material. Different mental model. Completely different financial outcome.

“We currently pay $[X] monthly to remove [specific waste stream]. I’ve contacted three companies that will pay us $[Y] monthly to receive that same material—they use it for [specific process]. The net swing is $[X+Y] monthly or $[annual figure]. Implementing this requires a material transfer agreement, which uses our standard vendor contract template with reversed payment terms. Legal review takes 2 weeks. The only operational change is the hauling company name on the loading dock schedule. We’re not becoming a waste business—we’re just changing who writes us a check versus who we write a check to.”

Notice the psychological judo. You’re not asking for a new business line. You’re describing a vendor swap—something companies do constantly with zero drama.

Waste-to-Revenue Implementation: 30-Day Action Plan

Week 1—Get Real Numbers (Not Estimates):

Schedule a waste characterization audit. This costs $500-2,000 depending on facility size and takes three days. A third-party auditor physically sorts your dumpster contents, weighs each material category, and calculates composition percentages and contamination rates.

You need this data because waste buyers won’t negotiate on “we throw away a lot of cardboard.” They need: “We generate 4.2 tons monthly of OCC (old corrugated cardboard) with less than 3% contamination by weight.” That specificity is the difference between “maybe we can take that” versus “we’ll pay $75 per ton with monthly pickup.”

The sensory reality: You’ll watch someone in Tyvek coveralls dump your trash onto a tarp in your parking lot and sort it into labeled bins with a hanging scale. It’s uncomfortable. Your facilities manager will hover nervously. Let them. The discomfort is part of the process—you’re making the invisible visible.

Week 2—Confronting the Contamination Problem:

Your waste characterization report will show that 30-40% of your “waste” is contaminated recyclables—cardboard with food residue, plastics mixed together, aluminum cans in trash. Material buyers reject contaminated streams immediately.

Here’s where most corporate responsibility programs fail: They try to fix contamination with employee training. “Please sort correctly!” They put up posters. Send reminder emails. Nothing changes because contamination doesn’t happen because people don’t care—it happens in the last 10 feet of waste handling.

Employees walking out of the break room with a lunch tray see one trash can by the door. They’re juggling a tray, coffee cup, and phone. They dump everything together because separation would require setting things down, sorting, and making three trips. The cognitive load is too high.

The physical fix: Install sorting stations at the point of generation, not collection. Put a three-bin system (trash, recycling, compost) directly in the break room where people finish eating—within arm’s reach. Use visual sorting guides with actual photographs of items, not text. A laminated photo of a pizza box with “Goes here” works better than “Food-soiled paper products.”

The sensory detail that determines success: Your bins need differentiated openings. Circular holes for bottles and cans (4-inch diameter). Rectangular slots for paper (10 inches wide, 1 inch tall). Flip-top lids for trash. Make it physically impossible to put the wrong item in the wrong bin without extra effort. You’re designing for muscle memory and spatial recognition, not decision-making.

Month 1—Creating the Waste-as-Inventory Dashboard:

Build a tracking sheet that treats outbound material streams like product inventory:

- Monthly tonnage by material type

- Revenue per ton (or cost for true waste)

- Buyer contract status and pricing trends

- Contamination rates and rejection incidents

Present this in your regular operations meeting—the same meeting where you review production output and efficiency metrics. Put “Material Recovery Rate” on the agenda between “Production Volume” and “Quality Metrics.” You’re normalizing waste materials as a product category that gets the same management attention as manufactured goods.

The psychological shift happens when your operations VP starts asking “Why did cardboard revenue drop 15% last month?” instead of “How much did we pay for disposal?” You’ve changed the question from cost minimization to value optimization.

The Brutal Reality of Waste-to-Revenue Systems

I need to be honest about something nobody mentions in sustainability case studies: Waste material buyers are unreliable, and commodity prices are volatile. That cardboard buyer paying $80 per ton this quarter might offer $20 per ton next quarter because China changed import policies, flooding the North American recycled fiber market.

You’ll need “safety valve” disposal contracts running in parallel. When commodity prices crash below your processing costs, you need the ability to send materials to disposal instead of paying to give them away. This means maintaining relationships—and paying minimum monthly fees—to waste haulers even while you’re actively selling materials.

Budget for 15-20% of your waste streams to have zero or negative value permanently. Mixed plastics, flexible films, certain foams, and composite materials (juice boxes, padded envelopes) have almost no secondary market value outside specialty programs. These materials will always cost money to manage. The goal isn’t “zero disposal costs”—it’s maximizing the percentage of streams that generate revenue or break even.

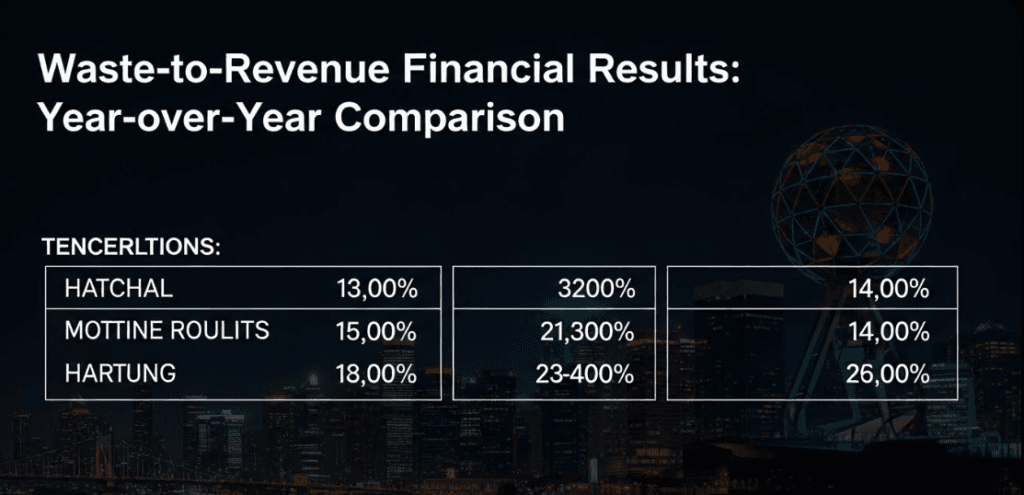

The financial reality after 12 months: A well-executed waste-to-revenue program typically reduces net waste management costs by 40-60%, not 100%. You’re shifting from paying $10,000 monthly for full-stream disposal to paying $3,000 for residual disposal while generating $1,500 in material sales revenue. Net savings: $8,500 monthly. That’s an 85% reduction in net costs—exceptional performance but not total elimination.

Zero Waste Certification Strategy: TRUE vs UL 2799 Comparison

Let’s address the elephant in the sustainability office: Zero waste certification feels like virtue signaling. Your operations VP thinks it’s “another audit that will slow down production.” Your CFO sees consultant fees and ongoing verification costs. Marketing wants the PR win, but everyone else is skeptical.

Stop positioning certification as an environmental credential. Start framing it as regulatory defense infrastructure.

The SEC’s climate disclosure rules (currently in legal limbo but directionally inevitable) will require publicly traded companies to report Scope 3 emissions and waste data with third-party verification. The EU’s Corporate Sustainability Reporting Directive (CSRD) mandates similar disclosure for companies doing business in European markets—even if you’re US-headquartered. These aren’t “maybe someday” regulations. Implementation timelines are already published.

When mandatory reporting hits, you’ll need verified baseline data, consistent measurement methodology, and historical trend documentation. You can build this infrastructure reactively by hiring consultants during the compliance scramble, or you can build it proactively through certification programs that create the exact reporting structure regulations will require.

“In [timeline], we’ll be required to report Scope 3 emissions and waste data to [investors/regulators]. Right now, we don’t have verified methodology or baseline data. Zero waste certification gives us a third-party verified system and historical trend data BEFORE mandatory reporting hits. When analysts ask, ‘What’s your waste reduction plan?’ we show certified results, not promises. Competitors scrambling to gather data in 2025 will report incomplete numbers and get downgraded. We’re building the measurement infrastructure now while we control the timeline. The certification costs $[X], but it’s actually the cheapest way to prepare for mandatory ESG reporting that’s already budgeted at $[higher Y] if we hire consultants reactively.”

You’re not asking for a sustainability initiative. You’re describing advance preparation for mandatory compliance—the corporate equivalent of studying for a test you know is coming instead of cramming the night before.

Zero Waste Certification Roadmap: 30-Day Implementation Guide

Week 1—Choose Your Certification Strategically:

Not all zero waste certifications are equal. TRUE Zero Waste requires 90% landfill diversion. UL 2799 offers platinum (100%), gold (95%), and silver (90%) levels. Some companies create internal “zero-to-landfill” certifications for specific facilities.

Here’s the strategic choice nobody tells you about: Start with your easiest win, not your biggest impact. Don’t try to certify your entire corporation. Certify one facility or one product line—preferably your newest facility with modern waste infrastructure or your highest-visibility consumer product.

Why? Because success stories unlock budgets and organizational enthusiasm in ways that “we’re working on it” reports never do. When you walk into next year’s planning meeting with “Our Phoenix facility achieved TRUE Gold certification with 95% diversion,” you’ve created proof of concept. Other facility managers start asking how to replicate it. Suddenly you’re not pushing a sustainability agenda—you’re responding to internal demand.

Week 2—The Waste-to-Energy Trap:

Schedule your pre-audit with your chosen certification body. They’ll review your current waste management contracts and material flows. Here’s where 90% of companies discover a painful truth: You’re sending 15-25% of your waste to “waste-to-energy” incinerators that you thought didn’t count as landfill.

Most zero waste certifications explicitly exclude incineration. Material that gets burned for energy recovery is not “diverted from landfill” in the certification definition, even if your waste hauler marketed it that way. This is the moment where your “we’re already at 80% diversion!” estimate crashes to “we’re actually at 55%.”

The physical fix requires renegotiating your waste contract to separate “residual waste” into a dedicated stream with specific disposal documentation. You need to know exactly where every material ends up—not just “not in a landfill” but “processed at [specific facility] via [specific method].”

The sensory reality: You’ll need to visit your waste processor’s facility. Certification auditors may require photographic documentation of where materials go. This means standing in a materials recovery facility watching your cardboard move through sorting equipment, or visiting a plastics processor to verify they’re genuinely recycling film instead of stockpiling it. It’s unglamorous detective work, not inspirational sustainability storytelling.

Month 1—Building Governance That Lasts:

The reason most zero waste certifications fail to maintain status after initial achievement: Companies treat it as a project with an end date instead of an operational system.

Create a “Zero Waste Governance Committee” with mandatory monthly 20-minute meetings. Not a task force. Not a working group. A standing committee with permanent membership—one representative from every department that generates waste (operations, facilities, food service, IT, procurement, marketing).

Single agenda item: “What went in the landfill bin this month that shouldn’t have?” Review the waste audit data. Identify failure points. Rotate meeting leadership among departments. Document solutions in a shared “Materials Playbook”—a living wiki that answers “Where does [specific item] go?”

The behavior change that determines long-term success: Make the Materials Playbook the first stop before anyone emails facilities with a “where does this go?” question. When someone needs to dispose of unusual items (old office furniture, electronics, carpet tiles), they check the playbook first. If the answer isn’t there, they add it after researching the solution. You’re building institutional knowledge instead of relying on one sustainability manager to know everything.

Corporate Zero Waste Certification Costs: Budget Reality Check

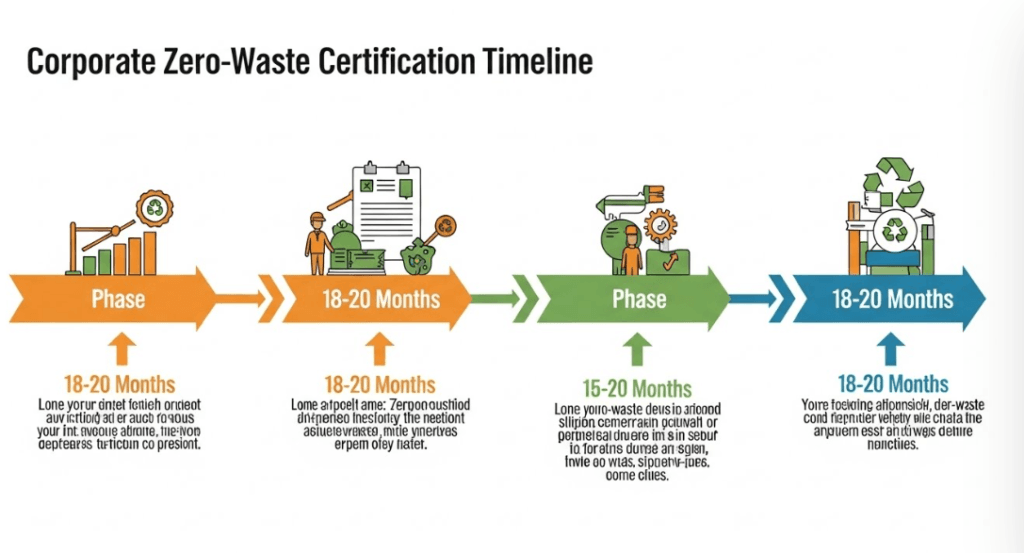

Zero waste certification isn’t a one-time fee. Annual re-verification costs $3,000-15,000 depending on organization size and certification level. You’ll need to assign approximately 0.5 FTE—half a person’s job—to maintain data tracking, coordinate quarterly audits, update procedures, and manage vendor relationships.

The first 12 months will expose operational inefficiencies you’ve been ignoring. Like discovering your janitorial service has been mixing recycling into trash bags for three years because “it’s faster and nobody checks.” Or finding out your food service contractor is throwing away 40 pounds of compostable material daily because their contract doesn’t include organics separation and your waste bins aren’t set up for it.

Fixing broken systems costs more than maintaining certified systems. When you discover that nobody trained the night shift on sorting protocols, you need to schedule training sessions across three shifts. When you find contamination issues, you need to install new bin infrastructure and update signage in four languages.

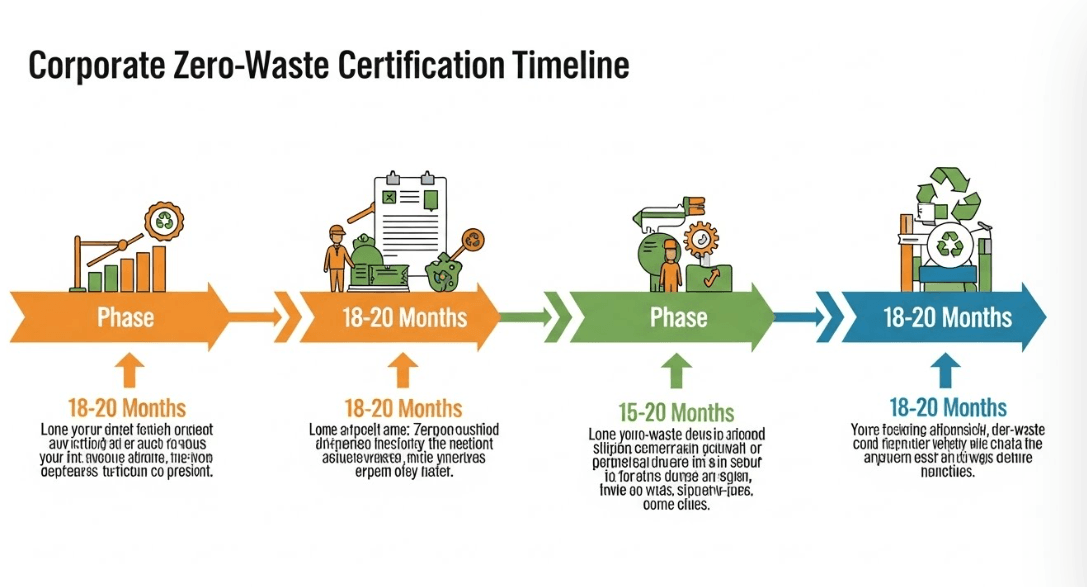

Budget for 18-month implementation reality, not the 6-month timeline in your project plan. The first six months is assessment and planning. Months 7-12 is implementation with constant troubleshooting. Months 13-18 is optimization and getting reliable data that meets audit standards. The certification itself happens around month 18-20 if everything goes well.

Companies that budget for six months get frustrated at month nine when they’re “still not ready” and abandon the effort. Companies that budget for 18 months hit month 15 and think “we’re ahead of schedule” and maintain momentum through certification.

Making Corporate Responsibility Financially Inevitable

Here’s what I wish someone had told me before I watched dozens of well-intentioned sustainability programs collapse: Corporate responsibility initiatives succeed when they become financially inevitable, not morally compelling.

The most successful zero waste business models I’ve documented didn’t start with passionate sustainability managers convincing skeptical executives to “do the right thing.” They started with finance teams calculating regulatory risk exposure and discovering that circular systems were cheaper than paying future penalty taxes.

Started with operations managers realizing that waste tracking data would be mandatory for investor reporting, so building measurement systems now was cheaper than emergency compliance later.

They started with procurement directors discovering that suppliers already offered takeback programs—they just had never asked the question.

The strategic insight that changes everything: Don’t fight the corporate incentive structure. Align zero waste initiatives with existing financial priorities. When circular supply chains become the path of least resistance for hitting quarterly cost reduction targets, you don’t need to convince anyone to care about sustainability. You’ve made sustainability the default outcome of pursuing profit.

This isn’t cynicism. It’s systems thinking. Corporations are designed to optimize for financial performance. Fighting that design is exhausting and fragile—every program depends on continued executive enthusiasm and protected budgets. Working within that design is sustainable—programs survive leadership changes and budget cuts because they’re embedded in operational logic.

The zero waste business models that scale aren’t the ones with the most inspirational mission statements. They’re the ones where finance, operations, and sustainability teams work toward the same metrics, speak the same language, and measure the same outcomes. Where waste reduction appears on the same dashboard as revenue growth and margin improvement. Where “material recovery rate” is a KPI that affects bonus calculations, not a nice-to-have sustainability report footnote.

You don’t need permission to start. You need data, strategic framing, and the patience to build systems one facility, one product line, one vendor contract at a time. The circular economy isn’t a revolution—it’s a series of unglamorous operational improvements that compound over 18-36 months into transformation.

Your competitors are waiting for perfect conditions, comprehensive budgets, and universal enthusiasm. You can start with a waste characterization audit, a spreadsheet, and one email to your top supplier asking if they offer reusable packaging. The company that moves first doesn’t need to be the most sustainable—they just need to be the most prepared when regulations and market forces make zero waste the only viable path forward.

That moment is coming faster than your CFO thinks. The only question is whether you’ll control the transition on your timeline, or scramble to comply on theirs.